11 Forex Trading Scams Exposed & Tips to Avoid Scammers in 2026

Around 32% of forex trading scam happen through social media platforms like Facebook, TikTok, Twitter, Instagram, and Telegram, according to Finance Magnets. And these trading scams are not limited to these platforms only.

Due to the allure of high returns, forex frauds are increasing day by day, targeting investors worldwide. And traders are falling for such scams easily.

But with the rise of forex scammers, rules and regulations are imposed, too. So, keeping yourself safe from forex scammers is no longer a dream but compulsory. And so, in this comprehensive guide, we will be talking about different types of forex scams and pro tips to avoid them.

Let’s dig in!

What Is Forex Trading Scam?

Forex trading scams are deceptive practices done in the forex market while trading, where fraudsters promise guaranteed profits to convince individuals to join fake trading platforms and make deposits. This fraudulent trading is often done through social media channels, unauthorized apps, and phishing websites.

Forex trading investment scams, also known as foreign currency trading scams, are mostly done by alluring an investor/trader with fake promises of higher profit with lower investment, which is a totally nonsensical promise scammers make.

If you know about forex trading, then you know there is no fixed profit or guarantee for a higher return every time

Michael Dunn, the former commissioner of the US CFTC (Commodity Futures Trading Commission), which regulates the entire foreign exchange market in the US, has already warned us about forex fraud being the most common form of fraud since August 2008.

However, making fake promises of higher returns in forex trading is an older type of scamming. Apart from this, forex scammers try to convince traders to change their brokers for just a better spread or profit.

How Forex Trading Scams Are Done

Trading scams happen by convincing people with fake trading or deceiving people with fake trading platforms, demanding money in the name of trading, or asking for unnecessary deposits, and then the brokers disappear.

Sometimes, forex trading scammers deceive you with mirror MT4/5 platforms by showing what you actually want to see. And when you make the deposit, the money is completely gone along with that fraud broker.

“

2 out of 3 retail forex traders lose money every quarter

— U.S. Commodity Futures Trading Commission (CFTC)

So, when someone is alluring with no loss, this should be a scammer, no doubt!!

Recently, a complete newbie asked on Reddit about how a forex trading scam actually works. As he was somewhat confused about a trader who does not share the financial credentials and never gives the deposit, how on earth could a scammer sue him?

And this is where the twist of the currency trading scam lies. Forex scammers convince traders with various types of greed, such as higher returns, better spreads, more accuracy, consistent profit, and more. And not only these; there are more. And traders get easily convinced by the scammers and fall prey to them.

For example, customers give deposits to unregistered forex platforms, or novices with no knowledge of automated trading give money to fraudulent brokers or sometimes share the trader account credentials with a deposit without even knowing that their account will be gone right after the handover.

Even sometimes we have seen that experienced traders can fall victim to forex scams! Because, with the rise of advanced technology and the decentralized forex market, people fall for scammers’ higher return claims and market data manipulations.

What Are the Various Types of Forex Scams?

Based on a number of different types of fraudulent activities in FX trading, the CFTC has imposed some rules and regulations to make people aware of such scams.

Along with some common scams in the forex markets, we are showcasing here every possible forex scam for your concern.

1. Point Spreads Scam:

Some dishonest brokers manipulate the market data and increase the bid-ask spread. It is one of the most common and older forms of forex trading traps that is done by computer manipulation, basically.

Usually, you get around 2 to 3 pips for a common pair such as EUR/USD. But a fraud broker might show you 7 pips or even more. They inflate spreads far beyond the market condition, especially during news events, causing instant losses or stop-outs.

Some brokers delay trade execution (slippage) or fake prices on rigged platforms to simulate losses, which is never justified by the forex market.

2. Accounts Churning for Commission

Account churning is when a broker makes excessive trades in your account just to earn more commissions or fees, not to make you profit.

This can happen when you give discretionary authority to the broker, and the fraudulent broker frequently buys and sells investments, resulting in

account churn.

This fraudulent practice can eat away your account, leaving you with losses only while the broker gets his full commission.

3. Signal Seller Scam:

The live forex signal scam is one of the most common types of forex fraud today. Here, scammers sell fake forex signals without any proper research and market analysis, claiming to be the most accurate and profitable.

But the worst part of the signal sellers is that they pretend to be trading experts and charge money for their fake forex signals. They promise big profits, show fake success stories, and then often disappear with your money.

Not all the

forex signals

are fake. Here are some of the

best and most reliable forex signal providers

that really exist in today’s time.

And here are some proven ways to

identify fake and real forex signal providers

on Telegram.

4. Ponzi and Pyramid Schemes:

In the Ponzi schemes, the scammers take money from the investors and pay it as a profit to other investors, showing a good profit with fake trading. Actually, no trading is placed here.

In a Ponzi scheme, no real trading is happening — just money being passed around like a circle. And the collapse occurs when there are not enough people to be fooled around, and they leave you with no money, saying it is a loss.

On the other hand, a Pyramid scheme is almost similar to a Ponzi scheme, where transactions are happening without any trading.

In a Pyramid scheme, scammers convince you to join their platform or group to earn money with forex trading, only by inviting more people to join. Here, you get paid for recruiting more people into this forex fraud group; no real trading is ever seen here.

Ponzi and Pyramid scams happen mostly with the newbies who know nothing about foreign currency trading and brokers.

5. Romance Scam:

When a forex scammer makes fake relationships with the customer to win trust and eventually manipulates them to make a deposit or give money on fraudulent forex, it is called a romance scam.

The CFTC study says that back in 2001, most of the romance scams were held through different dating apps. And in 2021, the number has increased and started happening on various social media platforms like Facebook, Instagram, or TikTok!

In a Romance scam, scammers push you to move the conversation off the platform or a private messaging social platform. Most of the victims of romance scams fall into the 18 to 29 age group, who get lured by a forex scammer to give money to the fake trading platforms.

6. Boiler Room Scams:

A boiler room scam is when some fraudulent salespeople call or message you pretending to be professional forex traders or brokers and convince you to deposit money as a trade investment.

These types of scammers work in an office with high pressure, like a boiler room, where they have a group of such people. They sound very confident and show you fake trading profiles and success stories stolen from others.

Once you give them money or share financial credentials, they vanish.

7. Blending Funds & Investors’ Money:

This type of trading scam is also known as a mini Ponzi scheme. Here, scammers use a single account for trading and other personal use. Simply put, it mixes your money with their own or other clients’ money in one big account, instead of keeping it separate and safe.

So, you can’t have any track of where your money is going. Scammers use your money to pay for their personal use or pay off bills and salaries. So, if they lose it or go bankrupt, you may get nothing back.

8. High Returns with Low Risk (HYIPs Scheme):

Low-risk and high-profit assurance is another common forex scam. And those who know currency trading must know that trading is never guaranteed with the highest return. There is no trade without loss. In a trade, one loses and another makes profits; this is how it goes.

So, if any person claims the highest returns with the lowest investment or guarantees you the highest profit, they are doing fraud, for sure. This type of forex fraud is also known as a High Yield Investment Program (HYIP).

9. Outright Fraud:

Outright fraud in forex trade is when there is no broker, no trader, or even any trading platforms, but claims expert-level trading with fake images and false promises.

Romance scams, pyramid schemes, and Ponzi schemes can be considered outright types of foreign exchange fraud.

10. Phishing/Spoofing Scam:

Website phishing is when someone creates a fake website similar to an official website and tricks people. With phishing websites or

spoofing websites,

scammers convince people to make deposits or share financial credentials without doubting, as the website URL seems exactly similar to a legit website with slight, unnoticeable changes.

This type of fraudulent activity is also called clone firming, where scammers build a fake company that copies the same name, logo, and details of a real, licensed forex platform.

These types of scammers look real, but actually, they are frauds and just want to steal your money.

11. Robot Scamming/AI-Driven Scams:

North American Securities Administrators Association (NASAA) President Leslie Van Buskirk said that AI-driven scamming will be on the rise in 2025. And this has been impacting the

Automated forex trading system.

Robot or forex trading bot scams are forex scams using advanced AI technology where scammers use artificial intelligence to create deepfake graphics and content, create fake trading apps, even voices of real, legitimate figures, to scam investors.

And this type of AI-driven fraudulent activity is mostly seen in forex signal scams. Forex signal scammers trick people with fake forex signals.

Besides, trading scams with fake EAs are another kind of forex scam where scammers pretend to give you real and reliable EA files for automated trading. But in reality, those EA files have no existence or legitimate programming. As a result, scammers take away your money, showing it as a loss in trade.

How To Spot a Forex Scammer: 8 Signs of a Fraud Broker

Now that you’re aware of forex scams, you might be wondering how to identify scammers, right? Well, we will showcase a list of forex trading scams to help you find out the forex scammers and avoid them.

1. Profit Assured Sales Pitch

One of the common and prime signs of a forex scammer is that they will lure you with quick profit assurance without risk. If you know a little bit about trading, then you know that there is no guarantee of profit here. Yes, you can gain profit, but there will be risks too.

So, if someone is assuring you a 100% profit gain for every trade, that is a red flag.

2. Requesting or Emphasizing Personal Details

If a person or a company is asking for personal details disclosure or asking for your financial details, it’s a scam, no doubt. To place a trade, you don’t need to share any personal information.

3. Lack of Regulatory Compliance

Fraud brokers will not have any compliance with the authorized entities. For example, different states have different foreign currency trading regulators, such as

- Commodity Futures Trading Commission (CFTC) in the US

- National Futures Association (NFA) in the USA

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- European Securities and Markets Authority (ESMA)

In 2024, among different forex scams, 30% were about brokers claiming false licensing to authorized officials or other fake entities. So, make sure your forex broker has authorization or regulatory compliance with the above official websites. If not, you must avoid him.

Check out the top 5 forex brokers to prevent fraudulent actions.

4. Claims for Non-Existence of Market Downturns

If someone is claiming that their trading strategies ensure no downturn, like there will be no market downturn if you follow their strategies, it’s a forex scam.

An Investopedia study says the Forex market is inherently volatile and unpredictable. So, there is no proven strategy yet that can ensure a 100% profit gain. If someone claims, it is a red flag!

5. Limited Time Offer/FOMO Type Scammer

AvaTrade has warned to avoid scammers pressuring to act quickly or ‘limited time offer’ deals.

to the sudden volatility.

This type of scammer tries to convince you with attractive offers that must be bought now or will be missed. It’s a FOMO (Fear of Missing Out) technique that is prevalent in trading scams.

So, cross-check everything before you step forward with such urgent offers.

6. Unnecessary Fees/Tax Demand

In July 2024, a USA trader found a broker demanding a 15% “tax” payment upfront to release funds. And if the payment is not made by a particular date, there will be a complaint to the IRS, and the victim’s credit will be affected.

If you face such kinds of messages or demands for any unnecessary taxes or fees, this is 100% fraud. Don’t fall for such trading frauds, as the IRS is not responsible for collecting fees.

7. Restrictions/Difficulties to Fund Withdrawal

WikiFX reports that fraudulent brokers often prevent their clients from withdrawing funds. Sometimes scammers put immediate limitations on accessing funds, demand unnecessary verification, or even deny withdrawal from the beginning.

In 2023, around 60% of forex scam reports were about denied withdrawals or imposed unnecessary fees. You might also get scammers citing technical issues for withdrawal delays and denying fund withdrawal, which is a scammer’s sign.

Well, we have reviewed some of the best forex trading mobile apps for you to get the best out of your trading without fear of getting scammed.

8. Cold Calling and Unsolicited Offers

Scammers reaching out to you with unsolicited investment offers are a sign of forex scams. Legit brokers don’t get involved in cold calling.

Also, if you get such offers on social media platforms or dating apps, it’s a scam. Any legitimate forex broker does not deal or communicate through social media platforms or dating apps.

However, to make you aware of the forex scammers, make sure to go through the scammers’ list of spoofing websites to avoid live forex signal scams in the name of SureShotFX.

Is Forex Trading Legitimate?

Yes, Forex trading is legitimate only if done through regulated platforms. Forex trading is one of the largest, most liquid markets in the world, with over $6 trillion traded daily. It’s widely used by banks, corporations, governments, and individual investors to exchange currencies

That’s why, to combat the rising forex scams, in 2010, the CFTC, along with the SEC (The U.S. Securities and Exchange Commission) and the NFA (National Futures Association), another regulatory agency for forex frauds, set up a special task force to deal with different types of foreign exchange scams.

That year alone, 193 forex fraud cases were filed, and 23% of victims recovered lost funds. Though investor reimbursement is not always guaranteed, you have the laws at least to file the case and expose the scammer.

How Do I Know If a Forex Trader Is Legit?

To find out if a forex trader is legit or not, check their regulatory compliance with authorized entities like the CFTC, NFA, etc. Also, check for licensed brokers.

For the rising forex scam nowadays, newbies are thinking about, “Is forex trading real or a scam?” – This type of question comes to mind naturally. But if you can get a legitimate platform and a real broker, you can also trade.

Check for forex currency trading reviews and testimonials before trying a platform to avoid getting scammed. You can also check how to choose the best forex broker and prevent forex scams.

Can You Get Scammed in Forex Trading?

Yes, you might get scammed in trading if cautionary steps are not taken. Be aware of unauthorized brokers or offshore trading where no regulation applies. Also, cross-check before making any deposit to unauthorized platforms or dealing with crypto assets.

Be especially aware of people who approach you on social media platforms, dating apps, messaging apps, or through unsolicited emails.

Expert Tips to Avoid Getting Ripped Off in Forex Trading

Though foreign currency trading scams have been so prevalent in recent years, taking some precautionary steps can help prevent them.

• Always choose brokers regulated by CFTC, NFA, or equivalent in your jurisdiction.

• Investigate the broker’s background, including company history, financials, and physical address.

• Check Trustpilot reviews to avoid forex signal scams and fake signal sellers.

• Avoid offshore brokers with no regulation or unclear licensing.

• Test the broker’s customer service responsiveness and support quality.

• Look for genuine trading reviews and testimonials from verified clients to avoid scammers.

• Watch out for fake testimonials and overly positive feedback.

• Check the CFTC red list or similar alerts for scam warnings.

• Avoid brokers with newly created websites or no testimonial history.

• Use a clear risk management plan and never invest more than you can afford to lose.

Why Do 90% of Forex Traders Lose Money?

Due to a lack of basic trading knowledge, 90% of forex traders fail and lose money on trading. Sometimes, traders trading without a better risk management strategy lose money in forex trading.

Also, having no proper knowledge of market conditions and not knowing how to use SL and TP in trading can lead to losing money.

So, it shows that if you want to trade with profits, you must start with the basic knowledge of forex trading, along with being cautious about all the scams in forex trading.

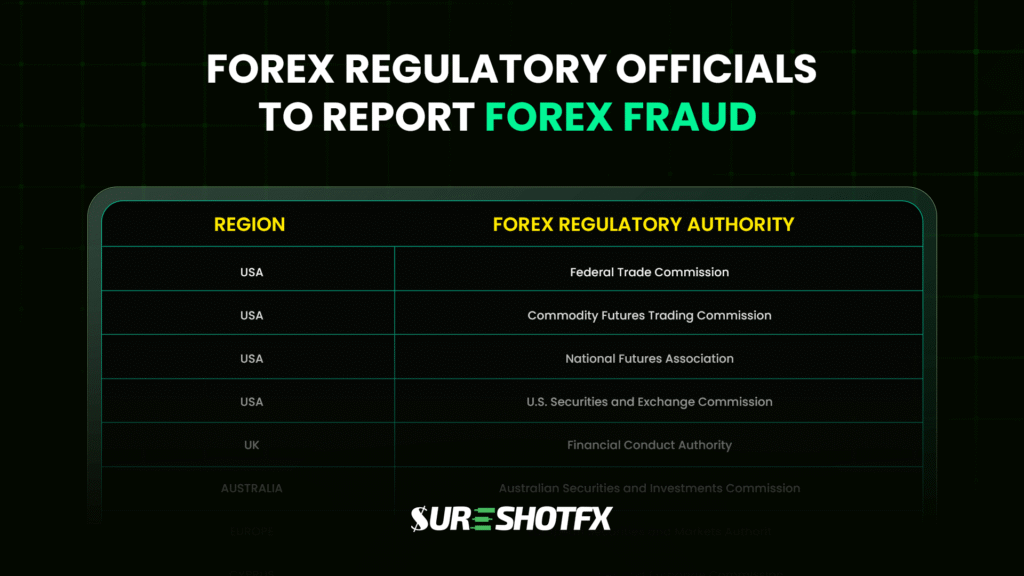

What to Do If You Get Scammed by Forex Frauds?

If you ever get scammed by currency trading frauds, make sure to contact your region’s forex regulatory service.

Here is a list of the forex regulatory officials to report fraudulent activity or forex fraud.

| Region | Regulatory Complaint Site | Regulatory Website |

|---|---|---|

| USA | FTC | Federal Trade Commission |

| USA | CFTC | Commodity Futures Trading Commission |

| USA | NFA | National Futures Association |

| USA | SEC | U.S. Securities and Exchange Commission |

| UK | FCA | Financial Conduct Authority |

| Australia | ASIC | Australian Securities and Investments Commission |

| Europe | ESMA | European Securities and Markets Authority |

| Cyprus | CySEC | Cyprus Securities and Exchange Commission |

| California | DFPI | Department of Financial Protection & Investment |

Final Thoughts

Forex currency (Forex) fraud is too prevalent nowadays. But that does not mean you avoid trading. Instead, avoid these forex scammers by learning about various scams and how to prevent them.

Besides, laws and regulations are imposed to prevent forex trading scams and ensure that forex trading is smooth and transparent. If you think you encounter a forex fraud, reach out to your region’s forex regulatory official website and file a complaint against the fraud.

FAQs:

Forex trading is not a scam if done properly using authorized platforms. But yes, trading scams are also real and happening. So, forex trading is legit, and if you want to trade legitimately, you must trade with authorized platforms as well as authorized and expert brokers.

Of course! Forex trading is real. Due to the rise of advanced technology like deepfakes and AI, currency trading scams now seem to be everywhere. So, many think of this as fake. But such foreign currency trading is real and happening in the forex market and is being regulated by the region’s financial authorities worldwide.

To identify a forex scammer, the first thing you can find is that the broker is not licensed by the official regulatory entities. A forex scammer might approach you with limited-time investment offer deals or lure you with low-risk, high-return claims. Make sure to avoid such frauds.

No, forex trading is not a bad idea. Instead, forex trading is a legal trading where trillions of currency units are traded daily worldwide. With proper strategies and steps, profitable returns are possible. However, if you don’t have any trading knowledge or you don’t have any idea of the forex market, forex trading is not for you.

Yes, a forex broker can be a scammer. For this, you must check the broker’s authorization with official regulatory entities and check for real reviews and testimonials before you start trading.

A legit forex broker is like a good referee—fully licensed with official regulators, plays by the rules, and never pressures you to make a move. Besides, legit brokers provide full risk disclosure documents on their websites and do not ask for taxes and unlocking fees for withdrawal.

No, forex trading is not gambling. Because of trading with currencies, forex trading might seem like gambling, which eventually leads to scamming. But in reality, forex trading differs from gambling. Forex trading includes proper strategies, market analysis, and moves with tactical risk-management setups, whereas gambling refers to betting money recklessly.

Yes, forex trading is profitable. Due to its high liquidity and vast forex market, forex trading carries a significant possibility of profit gain along with risks. In short, the forex market is profitable, but the profit is not guaranteed every time.

One Comment