How to Get Funded in 2026: Beginner Guide

Welcome to another insightful blog from SureShotFX, where we dive deep into the reasons prop traders don’t get funded. If you’re reading this, chances are you’ve faced the harsh reality that getting funded is no walk in the park. But fear not, as in today’s blog, we’re unpacking the top three profit statistics and two strategies from the SureShotFX trade team. With the help of these, you can significantly boost your chances of not only securing funding but also sustaining it over time.

1. The First Hurdle to Get Funded: Only 30% Make it to Payout

Angelo, CEO of the funded trader, dropped a truth bomb: a mere 30% of those who get funded make it to their first payout. Shocking, right? Reflecting on personal experiences of SureShotFX Trade Team, blowing funded accounts was a reality for many prop traders However, it was driven primarily by two culprits: greed and impatience.

Greed tempts us to overleverage on what seems like a golden opportunity, leading to massive losses. Meanwhile, impatience, fueled by unrealistic profit expectations, pushes traders to risk more than they should. The key lesson here is to approach funding as a new mountain to climb, with caution and a focus on long-term sustainability.

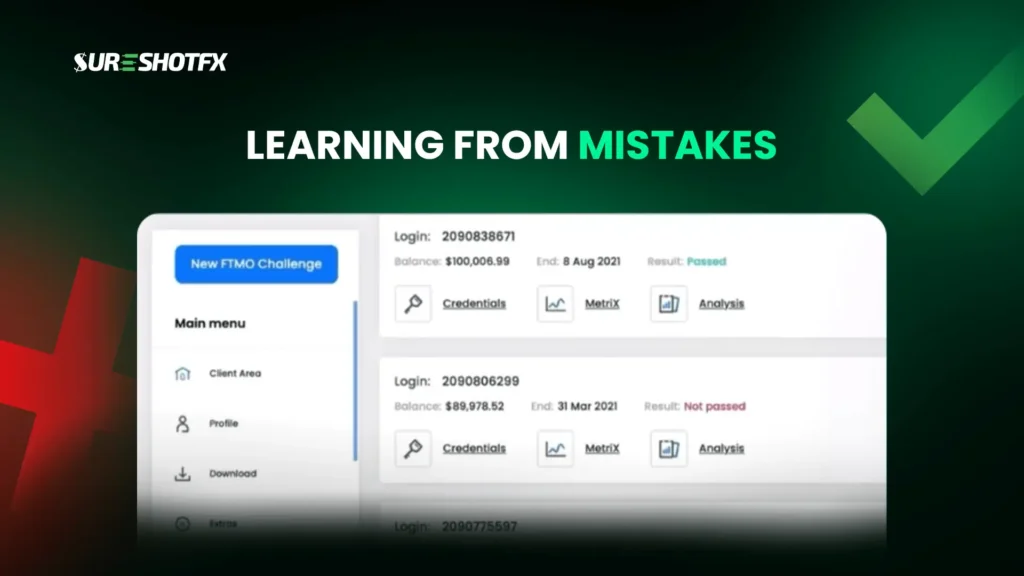

Learning from Mistakes: The Greed and Impatience Trap

If you look at one of our known prop trader’s FTMO dashboards, the trader has blown three funded accounts due to these common pitfalls. Over-leveraging and impatiently risking 1% from the start were the main reasons for these disasters.

Yes, if you get funded, that is exciting. However, to get your first payout, you must not get out of your focus. If you start thinking that this is live money now, you can risk more if you find a clean setup. You end up overleveraging. And once your account gets below a certain percentage of drawdown, you start to get fearful and start revenge trading. Secondly, if you start risking 1% right from the start, there’s a huge risk. Let us break it down. When you are risking 1% off the bat, you will be risking 10% on one trade idea, which is crazy!

The crucial advice? Start small, risking 0.25% to 0.5% per trade idea, building a cushion before gradually increasing risk.

Realistic Profit Targets: Aim for Sustainable Growth to Get Funded

One of the most important factors to keep in mind is “Setting Realistic Profit Targets.” Do not get hyped up by seeing astronomical gains flaunted on social media by others. If you compare them to any average hedge fund’s 10-20% yearly returns, aiming for 1-3% each month is a more realistic profit target for you as a retail trader.

“Sustainable profits lead to lasting success.”

2. The Second Statistics: The Gamblers Among Us

Smart Funded Trader’s statistic reveals shocking data. “About 400 challenges were blown in the first week alone! “

This prompts a crucial reminder: trading challenges aren’t a game of chance. Traders who play with NEWS trade like it’s a game. And they are taking a big risk with their accounts. There are a lot of traders who will just wait for high-impact news to enter a trade. They will either pass the challenge or hit stop loss and blow their account.

Traders have to achieve specific goals, like keeping the drawdown limit and hitting the profit target, to succeed in the funding challenge. If they break any of these rules during the assessment, they can’t move forward, and they lose their account.

This puts a lot of pressure on traders to stick to these objectives. Many struggle to get past the first phase due to the strict drawdown rule. To address this, SureShotFX traders developed an EA called SureShotFX Guardian. This tool helps traders protect their drawdown limit effectively. While working on other challenge objectives, traders can rely on SureShotFX Guardian to keep their drawdown in check. Here are some features included in SureShotFX Guardian:

- Max Drawdown

- Daily drawdown

- Floating profit/loss

- Your limits are displayed directly on your MT4/MT5 screen.

- You will be alerted through Telegram in case your account reaches your set limit.

- You can also close all trades and check running trades through telegram.

So, what’s our advice? Make a plan and structure to achieve your profit targets instead of relying on just luck.

3. The Third Statistic: Quality Over Quantity

A surprising revelation from FundedNext shows that 12% of funded traders taking less than 15 trades per month secure nearly 55% of total payouts.

This contradicts the common belief that more trades equal more profits. Generally, we have seen many of our own GOLD VIP signal members taking one-two gold trades a week and securing payouts months after months. This is called calculated trading. You do not need to trade every day; you only need to trade 2-3 times a week, depending on your trading strategy. You will be more profitable this way than placing trades daily.

The takeaway? Quality beats quantity. Take calculated A+ setups rather than succumbing to the urge to trade daily.

4. Strategies to Get Funded for 2025: Aggressive vs. Conservative

Now, SureShotFX trade team has shared two approaches to get funded accounts in 2025: the aggressive and the conservative.

Aggressive Approach: Three Simple Rules

- Risk 1% per trade idea.

- Use a 1 or 2 risk-to-reward ratio.

- Limit yourself to a maximum of two wins and two losses per day, with a maximum of four losses per week.

This way you will only lose 2% in a day, securing your daily loss limit. Thus, with these rules combined with a proper signal setup from SureShotFX will streamline your path to funding.

The Conservative Approach: Slow and Steady Wins the Race

For those who prefer a low-risk, low-reward strategy, you can start with a conservative approach.

Start with a 0.5% risk

When your profit target reaches to a 2-3% margin, then increase your risk to 1%. This way, you are using your 2-3% acquired profit as a cushion. Of course, this method will take a bit longer, but this minimizes the risk of blowing your account. If you lose trades and lose the cushion, go back to the previous approach of risking 0.5% and start rebuilding. The other three rules are the same as the aggressive approach: max 2 wins/day, max 2 losses/day, and max 4 losses/week.

This way, you will be losing only 1% in a day, which is less than an aggressive approach.

SureShotFX Hit The News:

SureShotFX has been featured by top U.S. news portals like AP News, Financial Content, Union-Bulletin, and so on. Spotlighting its innovative impact on the trading community. With a 20% discount and all VIP channel access on Eightcap registration, don’t miss the chance to elevate your trading with SureShotFX’s unbeatable Forex signals and trade copier services!

In conclusion, whether you opt for the aggressive or conservative route, remember that getting funded is just the beginning. Sustaining and growing that funding requires discipline, strategic planning, and a focus on quality over quantity. May your trading journey be prosperous and funded!