What is Lot Size? How to Calculate & Its Importance?

So, finally, you have decided trading forex or thinking about trading forex. That’s great! But before starting trade forex, let’s have a detailed idea about one of the key factors: Lot size calculator mt4/mt5.

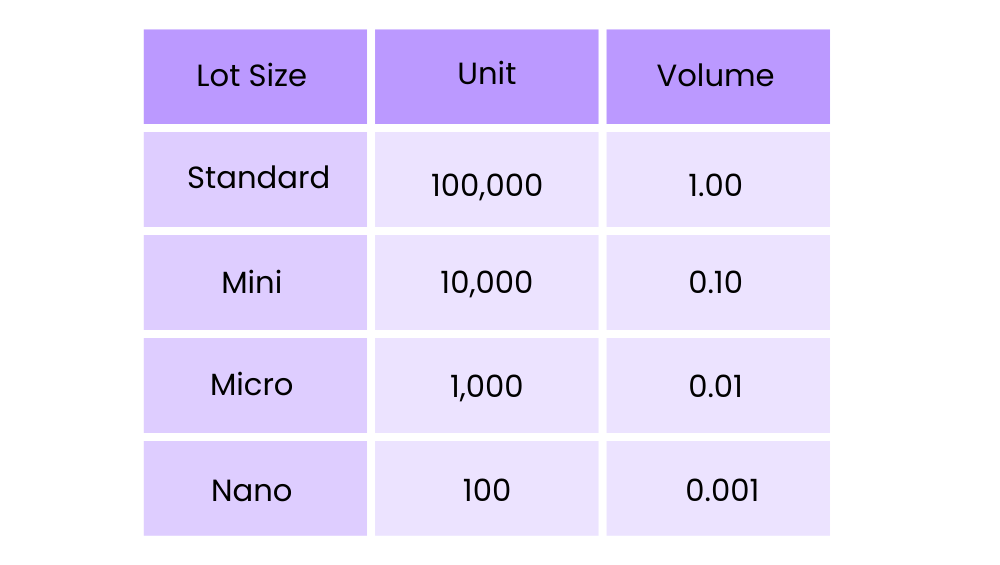

In simple words, it’s like deciding how much money you want to invest in one go. The standard lot size in forex is 100,000 units. But there are also mini lots (10,000 units) and micro lots (1,000 units). SureShotFX Forex Lot size calculator MT4 that makes the whole process easy for forex traders.

The SureShotFX Lot size calculator MT4 is a powerful tool that helps forex traders to accurately calculate their lot size. The calculator takes into account several factors, including the trader’s trading balance, risk percentage, and stop loss.

Before diving into the main topic, I expect you to have a basic idea about forex signals. Still, if you have confusion about it, you can look into the detailed information in this blog- What is Forex Signal & How to Find the Best Forex Signal? Hope it might help you!

What is Lot Size in General?

The term “lot size” describes the number of items ordered for delivery on a particular date or produced in a single production run. In other words, the total number of products ordered for manufacturing is meant by lot size.

But…

What is Lot Size in FOREX?

Basically, it is a number of currency units you are willing to buy or sell while trading forex. In our Lot Size in Forex blog, you will get an elaborate explanation of this matter. Don’t forget to check that out!

Now, let’s talk about the vital topic of this blog- Lot size calculator mt4/mt5.

What is Lot Size Calculator mt4/mt5?

To control your risk per trade, you can use the lot size calculator mt4/mt5 to determine the approximate number of currency units to buy or sell. In forex trading, lot size calculation is a crucial element of the risk management system.

Lot size calculator mt4/mt5 is one of the most efficient tools in forex trading to manage your risk while trading forex. This must-have tool should be in your trading bag all the time.

Why do you need Lot Size Calculator mt4/mt5?

You need a lot size calculator tool because-

- To find out the accurate lot size: It is most important to find the exact lot size while trading in forex. What will happen if you do not use accurate lot size? If you do not use accurate lot size while trading in forex, you might blow your account on one trade! So, a lot size calculator provides you with an accurate lot size so that you do not blow your trading account.

- To control your risk per trade: Controlling your risk per trade is one of the essential parts of forex trading. By using a lot size calculator, you can determine a minimum risk percentage while trading in forex.

- To help you with proper risk management– While using a lot size calculator, you need to select your trading balance, risk percentage, and stop loss. So, while calculating the lot size in a lot size calculator, you are not only finding out the lot size but also keeping the other factors of forex trading in check.

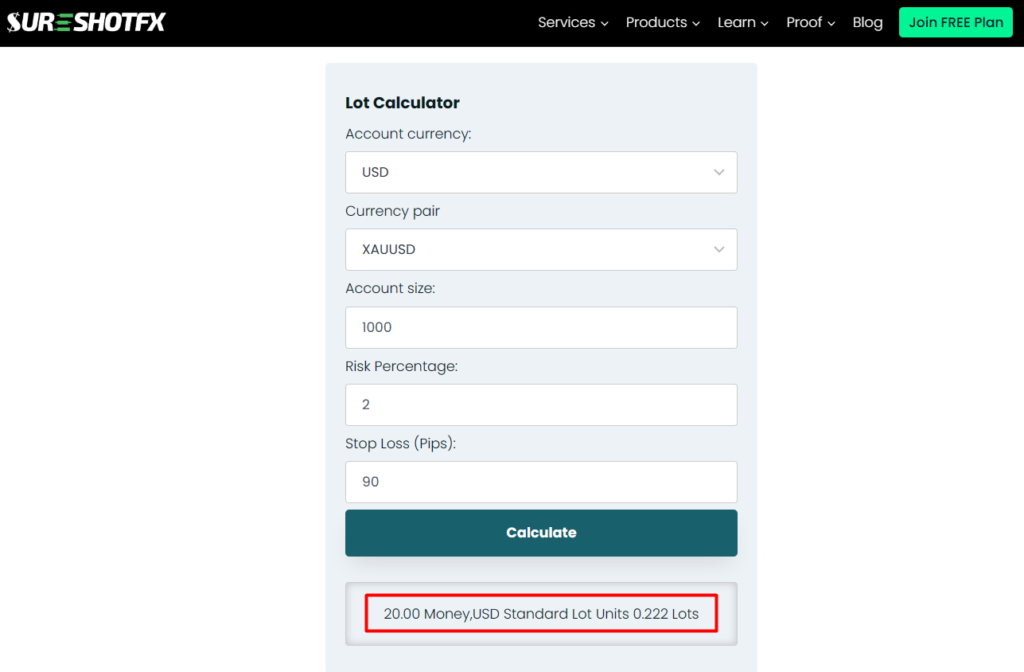

Basically, for these three reasons, you should use a lot size calculator. A lot size calculator helps you to find out your approximate lot size based on your provided information- Account currency, Currency pair, Account size, Risk Percentage, and Stop Loss (Pips).

How would you use Lot Size Calculator mt4/mt5?

To use the SureShot forex Lot Size Calculator, simply follow these steps-

- Visit SureShotFX> Products> Lot Size Calculator

- Input the following information:

- Account Currency

- Your Account Size

- Risk percentage

- Trading balance

- Stop loss in pips

- Click Calculate.

SureShotFX Lot Size Calculator will provide you with the approximate lot units that you may take along with the amount of money you are risking.

Benefits of Using the SureShotFX Lot Size Calculator

The SureShotFX forex Lot size calculator MT4 is user-friendly and simple to use. Making it suited for traders of all levels of experience. It makes complex calculations easier to understand. And ensures that traders can simply identify the right lot size for their trades.

Accurate lot size determination: The SureShotFX Lot calculator helps traders to accurately determine the appropriate lot size for their trade. This helps to avoid overtrading and maximize profits.

Variability: The SureShotFX Lot calculator can be used for a variety of currency pairs and trading scenarios. It will show you lot size recommendation according to the trade pair you will choose.

Accessibility: SureShotFX forex Lot size calculator MT4 is freely accessible and free on our website. This allows traders to utilize it whenever they want without paying any additional charges.

Risk control: The SureShotFX Lot calculator helps traders to control their risk by taking into account their trading balance, risk percentage, and stop loss.

Traders can experience less tension and anxiety connected with risk management. All thanks to the SureShotFX Lot calculator’s correct lot size recommendations. It gives you a sense of security and control. The SureShotFX Lot calculator helps traders to implement proper risk management.

Better Decision-Making: With SureShotFX Lot calculator traders can make more informed decisions regarding their trades. Leading to a more strategic and calculated approach to Forex trading.

Educational Value: It serves as an educational tool, assisting traders in understanding the relationship between lot size, risk percentage, and stop loss.

How much should you risk per trade?

Risk per trade should be a small percentage of your total trading account. But it is suggested to go for 2% for starting.

For example, you have a $1000 trading balance, and you want to trade EURUSD. So, you take a 2% risk with 50 pips stop loss. So, the suggested lot size will be 0.04(Standard lot units).

But let me be clear, stop loss also plays a vital role here. The more your stop loss, the less your lot size. So, check on your stop loss as well.

How to determine the lot size for the prop fund account challenge?

Prop fund account challenge has some rules and regulations that you need to maintain while taking the challenge, like how much you are allowed to lose and all.

Most traders lose the prop fund challenge because of lacking risk management. For example, when you take a prop fund challenge of a 100k account with a 10% drawdown, you should not set your risk management, considering the account as a 100k account.

You can easily use SureShotFX Lot Size Calculator to determine your lot size for the prop fund account challenge.

It’s wrapping time! A lot size calculator is undoubtedly part and parcel of forex trading. But, it is not the one and only tool that determines your risk management. There are other tools as well, like Pip Calculator. We will talk about it in our upcoming blog. Until then, have a great time with forex trading!

Related Blog:

I surely admired your website’s information. I had problem with stop loss, risk lot size and link between all these three.

Thanks a lot.

Thanks for your appreciation. Keep in touch with SureShotFX Blog.