Forex Trading Journal: Why & How to Create One

A forex trading journal is one of the most underrated tools in a trader’s journey—yet it’s often the single factor that separates consistently profitable traders from those who struggle. Many traders focus heavily on indicators, strategies, or signals, but fail to track how and why they trade. That gap is exactly where a trading journal delivers its power.

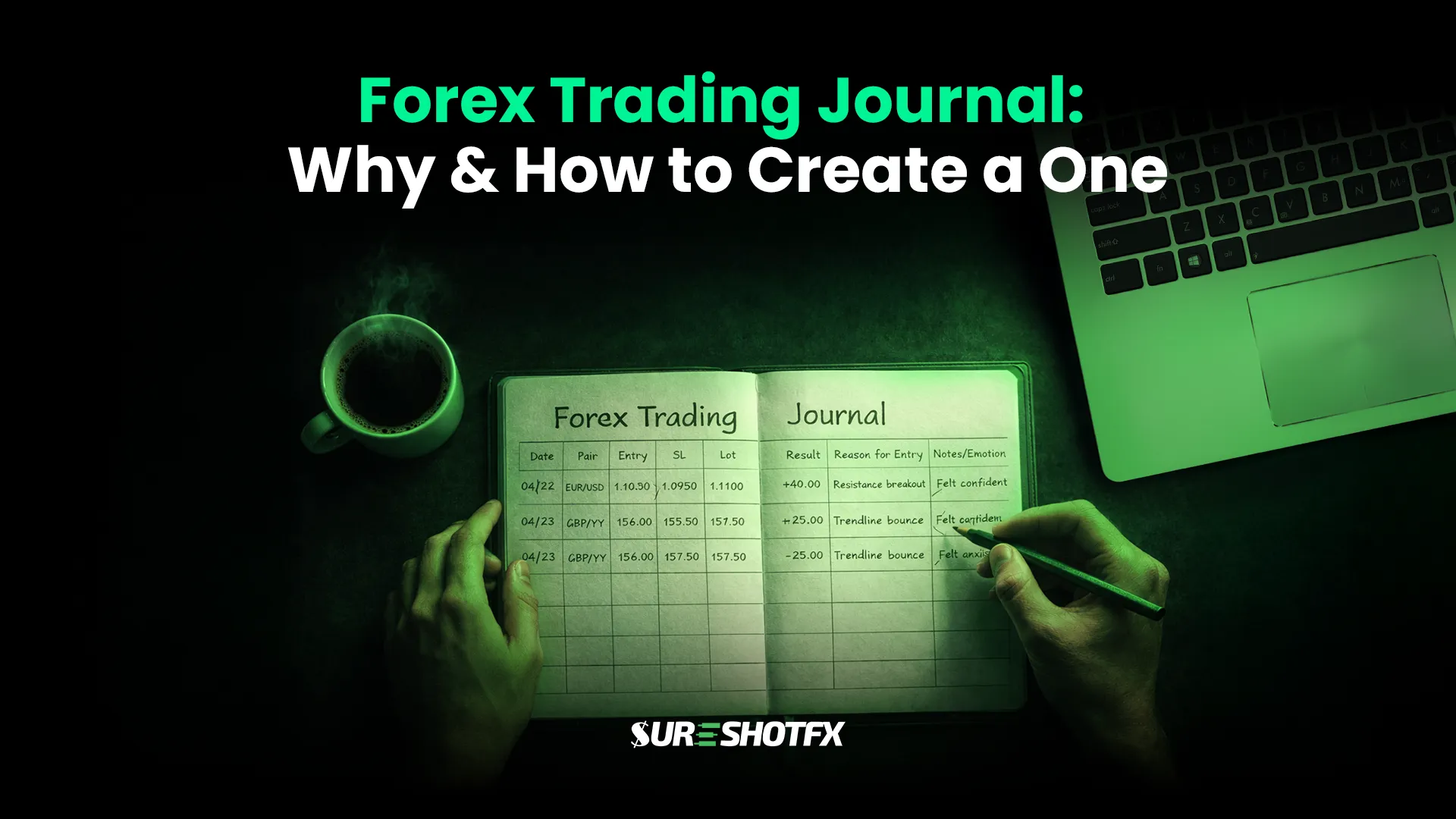

In simple terms, a trading journal is a structured system for trade tracking, performance analysis, and self-improvement. It goes far beyond recording wins and losses. Instead, it captures your decisions, emotions, execution quality, and outcomes—turning every trade into a lesson.

In this guide, you’ll learn what a trading journal means, why it’s essential for Forex traders, and exactly how to create a trading journal that improves consistency, confidence, and long-term results. By the end, you’ll know how to transform your raw trade data into actionable insights that compound over time.

What is a Trading Journal?

A trading journal is a personal performance database where traders systematically document and analyze every trade they take. In the context of Forex, a trading journal for Forex trading records not only price data, but also the reasoning, strategy, emotions, and execution behind each position.

Unlike a simple trade log or broker history—which only shows entry price, exit price, and profit or loss—a trading journal explains why a trade was taken and how it was managed. This distinction is critical.

A trading journal answers deeper questions:

- Why did I enter this trade?

- Was the setup part of my strategy?

- Did I follow my rules?

- What patterns consistently lead to profits or losses?

What a Proper Trading Journal Includes

A well-structured Forex trading journal acts as an essential tool for growth and typically includes:

- Entry price, stop-loss levels, and profit targets

- Trade rationale and strategy logic

- Market conditions at entry

- Risk-to-reward ratio

- Emotional state before, during, and after the trade

Over time, this detailed record allows traders to identify recurring behaviors and setups. You begin to see which strategies align with your personality and which mistakes repeatedly cost you money.

This is why a trading journal is best understood not as paperwork, but as a feedback engine.

Why Should Traders Keep a Trading Journal?

Understanding why traders should keep a trading journal is essential for anyone serious about long-term success in the financial markets. A trading journal is not just a notebook where you write down entry and exit prices. It is a structured record of decisions, emotions, strategies, and outcomes.

When used correctly, it becomes a powerful analytical tool that sharpens performance, strengthens discipline, and builds confidence. Traders who consistently document and review their trades gain clarity about what truly works and what silently undermines their progress.

Over time, this clarity turns into consistency—and consistency is what separates professionals from amateurs.

Building a Detailed Historical Record

Every trade recorded in a journal adds to a growing database of personal trading behavior. This historical record becomes one of the most valuable assets a trader can possess. Instead of relying on memory—which is often biased or incomplete—a trader can refer to factual, organized data.

Key Benefits of a Historical Trading Record:

- Eliminates emotional or selective memory bias

- Provides measurable performance metrics

- Tracks patterns across different market conditions

- Highlights recurring mistakes

- Strengthens long-term strategic decision-making

- Which market conditions favor their strategy

A trading journal transforms random trades into structured, analyzable data.

Strategic Planning and Validation

A trading journal naturally enforces better planning. When traders know they must document their reasoning before entering a trade, they become more deliberate. Instead of acting on impulse or social media tips, they define entry criteria, stop-loss placement, profit targets, and risk levels in advance.

Benefits of Strategy Verification:

- Confirms real-world profitability

- Measures consistency over 50–100+ trades

- Builds confidence through data

- Identifies necessary adjustments

If the journal consistently shows positive results, confidence increases. If not, refinements can be made based on measurable evidence.

Calculate System Expectancy

One of the most important analytical functions of journaling is calculating system expectancy. By tracking win rates, average wins, average losses, and risk-to-reward ratios, traders can determine whether their system has a mathematical edge.

Why System Expectancy Matters:

- Positive expectancy = Long-term profitability

- Converts trading from gambling to probability-based execution

- Strengthens confidence during drawdowns

- Encourages disciplined risk management

Mastering Emotions and Correcting Habits

One of the most underestimated benefits of keeping a trading journal is emotional awareness. Markets are highly psychological environments. Fear, greed, impatience, and overconfidence can quietly sabotage even the best strategies. Writing down emotional states before, during, and after trades exposes patterns that would otherwise remain hidden.

Common Emotional Patterns Traders Discover:

- Exiting winning trades too early due to fear

- Increasing position size after consecutive losses

- Overtrading during high volatility

- Hesitating after recent losses

Professional Skill Development

A trading journal plays a central role in developing professional-level skills. Not every trading style suits every individual.

Journal data may reveal:

- Poor performance in fast-paced scalping

- Stronger results in swing trading

- Better emotional stability on higher timeframes

- Improved results with fewer trades

Aligning strategy with personality increases both profitability and psychological comfort.

Accountability and Goal Setting

A trading journal fosters accountability by providing clear, measurable evidence of performance. Without data, traders often set vague goals such as “make more money” or “be more disciplined.” With a journal, goals become specific and measurable.

With a journal, goals become specific:

- Increase win rate by 5%

- Maintain 1:2 risk-to-reward ratio

- Limit daily risk to 2%

- Reduce emotional trade entries by 50%

Ultimately, the improvement in performance comes down to clarity, accountability, and consistency. For traders committed to long-term success, journaling is not optional—it is foundational.

How to Create a Trading Journal?

Creating a trading journal does not require complicated software or advanced technical skills. What it truly requires is structure, clarity, and consistent execution. A well-built journal acts as both a mirror and a map: it reflects your current trading behavior while guiding you toward measurable improvement.

Whether you are a beginner exploring the Forex market or an experienced trader refining your edge, following a clear step-by-step framework ensures your journal becomes a powerful performance tool rather than just another unused document.

Let’s break down the process in a practical and detailed way.

Step 1: Choose Your Format

The best trading journal is not the most advanced one—it is the one you will use consistently. Choosing the right format depends on your personality, workflow, and analytical needs.

Notebook

A notebook is ideal for traders who value reflection and emotional awareness. Writing trades by hand encourages slower thinking, which can reduce impulsive decisions. When traders physically document their trade rationale, emotions, and market observations, they often become more mindful of their behavior.

However, notebooks have limitations. Manual calculations can become time-consuming, especially for active Forex traders. A notebook works best for qualitative analysis rather than statistical performance tracking.

Excel or Google Sheets

Excel or Google Sheets provide a balance between flexibility and analytical power. Spreadsheets allow traders to automatically calculate key trading metrics such as win rate, average profit and loss, risk-to-reward ratio, and drawdown percentage. Traders can filter trades by currency pair, session, setup type, or signal provider with just a few clicks.

This format supports structured forex performance analysis without requiring specialized software, making it ideal for traders who want full control over their tracking criteria.

Dedicated Journaling Software

Dedicated journaling software is designed for efficiency and automation. These platforms often import trades directly from brokerage accounts, reducing manual entry errors and saving time. They generate visual reports, equity curves, performance breakdowns, and advanced analytics automatically.

This option is ideal for traders who want deep statistical insights with minimal administrative effort.

Step 2: Define Your Core Metrics

A trading journal becomes powerful only when it tracks meaningful data. Before placing your next trade, decide exactly what you will record for every position. Structure eliminates guesswork.

Technical Details

Start with technical details. These include the currency pair traded, entry price, stop-loss level, take-profit target, position size, and risk-to-reward ratio. These numbers form the foundation of performance analysis. Without them, you cannot calculate profitability, drawdowns, or system expectancy.

Strategy and Logic

Next, document your strategy and logic. What setup did you trade? Was it a breakout, pullback, range reversal, or trend continuation? What triggered your entry—price action, indicator confirmation, or support/resistance reaction? Include higher timeframe bias to show whether you traded with or against the broader market direction.

This contextual information explains the reasoning behind the numbers.

Specialized Data

You may also include specialized data to uncover deeper insights. Record the market session (London, New York, Asian), volatility level, and any major news events influencing price movement. Most importantly, track your emotional state. Were you calm and confident? Hesitant? Frustrated after previous losses? Emotional awareness often reveals patterns that technical metrics cannot.

The goal is consistency, not overload. Record only what helps you make better decisions.

Step 3: Record Trades Immediately

Timing matters when journaling. Small details fade quickly, especially emotional ones.

Immediate recording ensures accuracy. It captures the real reasoning behind the trade rather than a reconstructed explanation influenced by the outcome. Traders often justify losing trades differently after the fact. Logging trades in real time prevents this bias.

Honesty is absolutely critical. A trading journal must include:

- Losing trades

- Rule-breaking trades

- Emotional mistakes

- Impulsive decisions

A trading journal is not a performance showcase—it is a diagnostic tool. Accuracy builds insight. Insight builds improvement.

Step 4: Conduct Regular Reviews

Recording trades is only half the process. The real transformation happens during review sessions. Without review, journaling becomes data collection without direction.

Identify Strengths and Weaknesses

Start by identifying strengths. Which setups produce the highest win rates? Which currency pairs align best with your strategy? Do you perform better during certain sessions? Highlight what works so you can repeat it deliberately.

Next, examine weaknesses. Are losses concentrated in specific market conditions? Do rule violations occur after consecutive losses? Does performance decline during high-volatility news events? Recognizing recurring mistakes allows you to design corrective rules.

Set Realistic Goals

Use your reviewed data to set realistic goals for the next period. Instead of vague targets like “improve discipline,” aim for measurable objectives such as reducing rule violations by 20% or maintaining consistent 1% risk per trade.

Reviews can be daily, weekly, or monthly—but they must be consistent.

Step 5: Validate Your Strategy with Expectancy

After accumulating approximately 20 or more trades, it becomes possible to measure system expectancy. Expectancy determines whether your trading strategy has a statistical edge.

This calculation combines your win rate and risk-to-reward ratio into a single performance metric. If the result is positive—for example, 0.4 or 40%—it means your system generates 40 cents for every dollar risked over time. This indicates a sustainable mathematical advantage.

Expectancy shifts trading from emotional speculation to probability-based decision-making. Losing streaks become easier to manage because you understand that short-term variance does not invalidate long-term edge. Conversely, if expectancy is negative, the data signals the need for strategic adjustments rather than blind persistence.

Common Mistakes Traders Make While Maintaining a Trading Journal

Keeping a trading journal is one of the most effective ways to improve trading performance, yet many traders believe it “doesn’t work.” In reality, journaling fails not because the method is flawed, but because it is executed poorly.

Understanding the most common trading journal mistakes helps traders turn journaling into a consistent growth mechanism rather than an abandoned habit. Let’s explore the most common mistakes traders make and why avoiding them is essential for meaningful growth.

Incomplete or Inaccurate Records

Missing details such as entry rationale, stop-loss placement, risk-to-reward ratio, emotional state, or market conditions weaken data quality. Poor input leads to flawed analysis and unreliable conclusions.

Selective Recording (Logging Only Winning Trades)

Ignoring losing trades or rule violations creates distorted performance metrics. Win rate, expectancy, and average return appear inflated, leading to false confidence and repeated mistakes.

Inconsistent Journaling Habit

Journaling only when motivated reduces long-term effectiveness. Skipping documentation during losing streaks prevents traders from identifying patterns and correcting errors. Consistency builds discipline.

Failing to Analyze Trades Properly

Recording trades without structured review limits improvement. Traders must analyze recurring mistakes, execution gaps, and risk management performance. Data without interpretation does not create growth.

Using a Journal That Doesn’t Match Trading Style

Scalpers, swing traders, and position traders require different metrics. Overly complex spreadsheets or unnecessary analytics can create friction and lead to burnout. Simplicity improves sustainability.

These common trading journal errors explain why many traders believe journaling “doesn’t work”—when in reality, the issue is execution.

How Does a Trading Journal Help Traders Using Signal Providers?

A trading journal is especially powerful for traders who rely on external signal providers. When traders follow professional analysts, algorithmic systems, or social trading platforms, they depend on third-party decision-making.

This reduces direct control over strategy development but increases the need for performance tracking. A trading journal transforms signal trading from blind copying into measurable, data-driven execution. Instead of assuming a provider is “good” or “bad,” traders can verify performance with structured evidence.

Let’s explore how journaling empowers signal-based traders to make smarter, data-driven improvements.

Audit Signal Performance and Reliability

One of the biggest advantages of maintaining a trading signals journal is the ability to objectively evaluate signal providers. Many traders subscribe to multiple services or follow analysts across different platforms.

By logging every signal, traders can identify:

- Win rate and average risk-to-reward ratio

- Frequency of signals

- Maximum drawdown periods

- Whether risk parameters are clearly defined

- Alignment with broader market structure

Over time, patterns begin to emerge. Does the provider issue signals regularly? Are risk parameters clearly defined? Are signals aligned with broader market structure? These factors directly impact long-term performance.

Bridge the Gap Between Signal and Execution

A common misconception among signal-based traders is that losses are always the provider’s fault. In reality, many losses occur because of execution gaps. A trading journal highlights this critical difference.

By documenting actual execution details alongside the original signal parameters, traders can compare the two. If a signal reaches its target but the trader exited early, the issue lies in emotional discipline—not signal quality. This comparison creates accountability. It eliminates blame-shifting and encourages personal responsibility.

Bridging the gap between signal and execution ultimately strengthens performance consistency.

Optimize Risk Management

A common misconception among signal-based traders is that losses are always the provider’s fault. In reality, many losses occur because of execution gaps. A trading journal highlights this critical difference.

By documenting actual execution details alongside the original signal parameters, traders can compare the two. If a signal reaches its target but the trader exited early, the issue lies in emotional discipline—not signal quality. This comparison creates accountability. It eliminates blame-shifting and encourages personal responsibility.

Bridging the gap between signal and execution ultimately strengthens performance consistency.

Optimize Risk Management

Risk management is often where signal-based traders customize decisions. While providers may suggest position size or risk percentage, individual traders frequently adjust these parameters based on account size or comfort level.

A trading journal allows traders to track how signals perform under different risk settings. Optimized risk management transforms signal trading from reactive copying into structured capital management.

Stop Repeating Mistakes

Repetition is common in trading mistakes. Without documentation, traders often repeat the same execution errors unknowingly. A trading journal exposes these recurring patterns clearly.

For signal-based traders, common mistakes may include:

- Entering trades late after price movement

- Skipping signals after recent losses

- Closing trades early due to fear

- Increasing risk after a losing streak to recover faster

When these behaviors are written down and reviewed regularly, they become impossible to ignore. Patterns that once felt random reveal themselves as consistent habits.

The act of measuring behavior increases awareness. Awareness enables correction. Over time, journaling turns repeated mistakes into refined processes.

Criteria to Track in Trading Journal While Using Trading Signals

When using trading signals, maintaining a structured and detailed journal becomes even more important. Signal-based trading introduces an additional layer of complexity because performance depends not only on market conditions but also on signal accuracy and personal execution discipline.

Below are the essential criteria that should be included when journaling trades based on signals, along with a deeper explanation of why each one matters.

Signal Provider Name

Identify which provider issued the signal so you can compare performance, consistency, and reliability over time, especially if you follow multiple sources.

Original Signal Details (Entry, SL, TP)

Record the exact entry price, stop-loss (SL), and take-profit (TP) levels provided. These serve as the benchmark for evaluating the signal’s intended strategy.

Execution Details (Actual Entry and Exit)

Document the price at which you actually entered and exited the trade. This helps measure slippage, delays, or personal timing differences that may impact results.

Deviation (SL/TP Modifications)

Note whether you changed the original stop-loss or take-profit levels. Tracking adjustments ensures transparency and highlights discipline gaps.

Reason for Deviation

Clearly state why changes were made, such as panic, greed, hesitation, overconfidence, or adherence to a personal risk plan. This reveals emotional patterns affecting performance.

Market Condition (Trending, Ranging, High Volatility)

Describe the overall market environment at the time of the trade. Market context helps explain why a signal performed well or poorly.

This structure enables accurate forex signal performance tracking and improves execution discipline.

Final Thought

A Forex trading journal is not an administrative task—it’s a skill amplifier. It transforms random outcomes into structured learning and replaces emotional decisions with data-driven confidence.

The best way to use a Forex trading journal is through long-term consistency, honest self-assessment, and regular review. Whether you’re a beginner or an experienced trader, journaling sharpens self-awareness, improves discipline, and builds the edge that most traders are missing.

In the end, strategies may change, and markets may evolve—but a well-maintained trading journal ensures that you keep improving.

FAQs on Forex Trading Journal

To create a Forex Trading Journal, start by recording trade details such as entry price, exit price, stop loss, take profit, lot size, risk-reward ratio, and trading strategy.

Yes, a Forex Trading Journal can significantly improve profitability. By reviewing past trades, traders can identify patterns—leading to more consistent results over time.

Absolutely. A Forex Trading Journal is especially important for beginners because it accelerates learning. It helps new traders understand their strengths and weaknesses, and avoid repeated mistakes.

Both options work well. Excel and Google Sheets offer customization and flexibility, while specialized Forex trading journal software provides automation, performance analytics, and visual reports.

A trading journal turns signal trading into a data-driven performance system. It builds accountability, improves execution accuracy, and helps traders optimize both provider selection and personal discipline.