Scalping Vs Swing Trading: Key Differences with Best Uses

A 2024 study found that over 60% of retail traders lose money due to poorly defined strategies. Two of the most common trading styles are scalping and swing trading—but when it comes to scalping vs swing trading, which strategy fits you best?

This totally depends on your trading experience. The key difference between swing and scalp trading is that scalping suits traders who prefer quick, small profits, while swing trading is better for aiming larger gains over longer periods with fewer trades.

Both approaches come with unique benefits, risks, and best practices. In this guide, we’ll break down the pros and cons of scalping vs swing trading, with practical insights to help you choose the style that matches your goals, experience, and trading personality.

➤ Scalping involves rapid, frequently short-term trades with tight stop-loss and lightning-fast execution.

➤ Swing trading focuses on capturing larger price movements by holding positions for several days or weeks with fewer trades but lower commission costs.

What is Scalping? How Does Scalping Work?

Scalping is a very short-term trading method where trades are executed within minutes, sometimes in seconds. In scalping, traders mainly target taking profit from small price movements.

Scalping works by placing one or multiple trades within minutes and aiming for a few pips or cents of profit each time. Scalping usually involves multiple trades, even hundreds of trades in a day. Traders employing the scalping method are known as scalpers.

According to Verified Market Reports, in 2025, scalping trading is so acute in Japan, especially in the mobile scalping market. And it’s because scalping is a high-frequency trading style with quick trade execution, so you can trade anywhere on the go.

For example, a scalper trading FX may execute a trade as follows-

EURUSD BUY 1.1601

SL: 1.1576 (25 pips)

TP: 1.1651 (50 pips)

Here, a 50-pip movement of profit using a large position might seem to be a tiny profit gain. But such multiple trades in a day can add up to a large, meaningful profit. However, commissions and slippage may reduce net profit.

For your information, scalping is completely legal and legitimate in forex, indices, and gold markets. But for the stock market, individual brokers might have leverage terms and conditions for scalpers.

Key Characteristics of Scalping

| Time Frame | Seconds to minutes |

| Trade Frequency | Higher, 10 to 100 trades/day |

| Emotion Control | High emotional & execution demands |

| Dependency | Heavily depends on liquidity & tight spreads |

| Time Required | Full attention and quick decision-making |

| Ideal for | Traders with time, discipline, and risk tolerance |

| Pros ✔ | Cons ✖ |

|---|---|

| Fast trade execution | Not suitable for beginner traders |

| Quick profit | Chances of higher fees & slippage |

| Multiple trade opportunities | Can be mentally exhausting |

| Best opportunity during market volatility | |

| Works best in sideways markets |

5 Scalping Trading Strategies in 2026

Scalping strategies are short-term trading techniques that involve quick execution, aiming for small, rapid profits with tight risk control. Momentum trading. Among different strategies, the following are the 5 best scalping strategies:

1. Market-Making Scalping

In this scalping technique, the trader places limit orders, such as buy limit and sell limit, around the

bid-ask spread to cover a larger profit margin.

Indicators, such as Depth of Market (DOM) and Level 2 quotes, are mostly used in this scalping strategy.

Best for: highly liquid major pairs and blue-chip stocks during calm periods

2. Momentum Scalping

If you ask which strategy is the best for scalping, then Momentum is the answer. In momentum scalping, traders

enter a trade right after any news or breakouts to grab the chance of a market move.

For momentum scalping, traders use indicators like RSI, MACD, and news scanners.

Best for: News hours, high-volatility events

3. Trend Scalping

Trend scalping is one kind of mini trade where a trader captures small price movements during minor pullbacks.

For trend scalping, 9/21 EMA crossovers, MACD, and trendline indicators are used most.

You can also check some of the best scalping EAs to become a profitable scalper.

Best for: Short-trend moves.

4. Range Scalping

Range scalping is when a trader buys at support (the point from where the market starts going upwards) and

sells at resistance peak (the point from where the market starts going downwards). You can guess how

experienced a trader needs to be for such a trading strategy; you must know the market moves very well.

For range scalping, traders usually use Bollinger Bands, pivot points, and RSI.

Best for: Consolidating sideways markets

5. News-Based Scalping

News-based scalping is based on real-time economic calendars. This type of trade is done by instant reaction

to the sudden volatility.

Scalpers mostly use the Forex Factory Calendar and Bloomberg News for news-based scalping. SureShotFX Algo has

the Forex news protection strategies suitable for scalpers to filter out unfavorable volatility that makes the

entire AI trading just worth it. Check the Algo trade results to see how this Algo is booming!

Best for: Events like FOMC, CPI, NFP

What is Swing Trading? How Does Swing Trading Work?

Swing trading is a technique that targets short- to medium-term price movements, holding trades for a few days to weeks. Swing is a popular trading style, allowing traders to benefit from market swings without needing to monitor charts constantly.

Traders employing the swing method are called swing traders. Swing trading is an active trading strategy where traders typically execute fewer trades. Unlike Scalpers who make multiple trades daily, swing traders mainly focus on maximizing profit.

Swing trading works by technical analysis of the market, such as studying price charts and market movement patterns.

For example, a swing trader places a buy trade for the following order-

GBPAUD BUY 2.0900

SL: 2.0800 (100 pips)

TP: 2.1300 (400 pips)

For this, a trader can have a check on the charts and manually close the trade or wait until it hits the TP or SL. So, this trade might take several days or some weeks, depending on the market movements and trends.

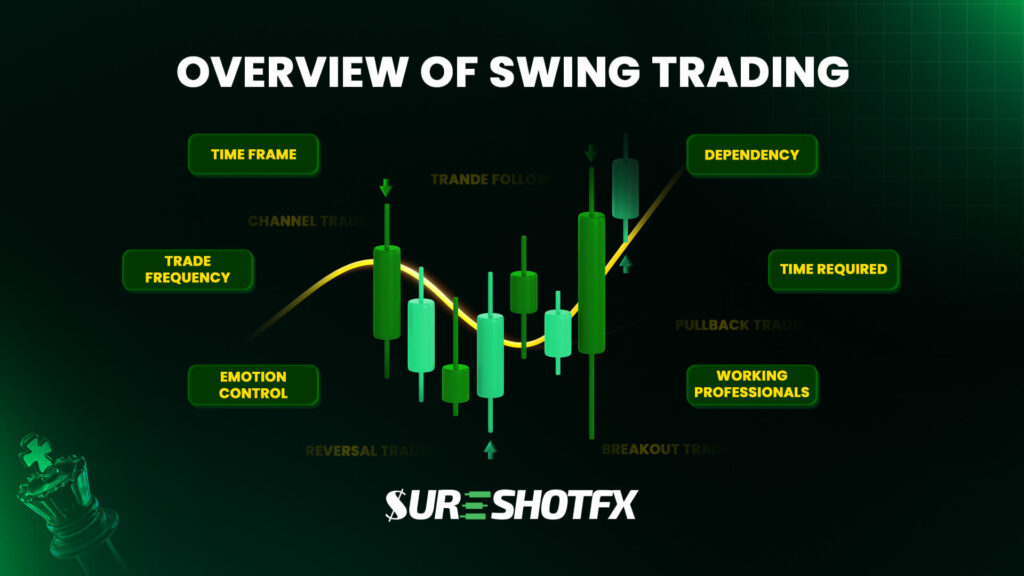

Key Characteristics of Swing Trading

| Time Frame | Days to weeks. |

| Trade Frequency | Moderate, 5 to 15 trades per month |

| Emotion Control | Needs a moderate level of emotion control and analysis |

| Dependency | Depends on market trends |

| Time Required | Minimal, part-time schedule opportunities |

| Ideal for | Beginners, working professionals |

| Pros ✔ | Cons ✖ |

|---|---|

| Flexible for working professionals | Must follow the trend discipline |

| Suitable for beginners trying luck | Chances of missing daily pips |

| Larger profit gain chances | |

| Balance between time investments and returns |

5 Swing Trading Strategies in 2026

Swing trading strategies are methods that help traders catch medium-term price movements. These strategies use tools like trendlines, Bollinger Bands, moving averages, and RSI to find the best times to enter and exit trades.

Let’s learn about 5 popular swing strategies-

1. Trend Following

This is the most popular swing trading strategy. Imagine a stock moving consistently upwards—that’s an uptrend, and a stock moving consistently downwards—that’s a downward trend! You want to buy into these uptrends and sell when the momentum starts to fade.

Here, the 50/200 SMA, ADX, and trendlines are some good indicators for swing trading.

Best for: Strong directional markets

2. Breakout Trading

Breakout strategy in swing trading works with support and resistance levels. Here, a trade is placed right after a breakout from the price pattern/trends.

When the price drops to a support level and starts to bounce back, it’s profitable to buy trades, and when the price goes to a previous resistance level and starts to go down, it’s suitable to sell trades.

For such a swing strategy, traders use Bollinger Bands, pattern zones, consolidation, etc., tools.

Best for: Profitable earnings

3. Pullback Trading

Pullback trading is a trading strategy applied when the market goes through a retracement or temporary price decline. Traders employing the pullback method believe that the market will continue the upward trend after a pullback, and so they place the trade during a dip to get more profits.

For your information, in pullback trading, traders place ‘Buy Limit’ and ‘Sell Limit’ orders, which are basically pending orders waiting for the retracement. Fibonacci levels, RSI (Relative Strength Index), and trendlines are usually used for pullback trades.

Oh! SureShotFx Algo combines such swing styles to get the most out of your scalping without any manual efforts.

Best for: Steady trending markets.

4. Reversal Trading

Reversal trading is like catching the market turn with higher risks and higher returns. During swing trading, traders applying a reversal strategy look for a chance or momentum, or spot an endpoint reversal when the market is going to reverse the trend.

Suppose a strong bearish candlestick pattern is about to turn downwards or a strong bullish candlestick pattern is going to turn upwards. That’s when a trader places a trade from an entirely new movement with potential profit gain.

Indicators like the relative strength index (RSI) divergence, moving average convergence divergence (MACD), and candlestick patterns are used here.

Best for: Exhausted trends

5. Channel Trading

Channel trading is placed when a market is moving up and down between 2 parallel lines. As we have learned about ‘support’ and ‘resistance’ levels, 2 parallel lines are drawn at these two levels.

Now, the price movement between these parallel lines is called a channel. And the trade that will be placed between this channel is called channel trading.

Parallel trendlines, Bollinger Bands, and Donchian channels are usually used in his trading.

Best for: Sideways trending markets

Quick Comparison Table: Swing Trading Vs Scalping

| Aspects | Scalping | Swing Trading |

|---|---|---|

| Time Frame/Trade Duration | Seconds to minutes | Days to weeks |

| Trade Type | Extremely short-term trade | Medium to long-term trade |

| Trade Frequency | Multiple trades | Few trades |

| Risk Management | Extremely tight stop losses or no SL | Wider stop losses |

| Profit Targets | Smaller but multiple | Larger with fewer trades |

| Analysis Required | Technical analysis | Both technical and fundamental analysis |

| Decision-Making Time | Need quick, decisive actions | Actions with patience |

| Trader Traits | Vigilance and impatience work well here | Greater patience and precision to understand trends |

| Stress Type | Highly stressful | Less stress |

| Chart Use | Uses minute charts | Uses daily charts |

Swing Vs Scalping: Detailed Comparison

The visible difference between swing and scalping is the timeframe. But there’s more. So, let’s have a one-on-one battle.

• Shorter Time Frame with Scalping than Swing Trading:

Scalping executes a trade within a tiny time frame, ranging from a few seconds to 5 minutes. On the other hand, swing trading continues to hold a position for days to a few weeks.

However, the average trade holding time in scalping is typically under 3 minutes.

• Comparatively Tight Risk Management in Scalping

Scalpers use a very tight stop-loss setup because of ultra-fast trade execution. One slippage can eat away the whole account. So, the risk per trade in scalping is generally kept below 0.5%.

Contrarily, swing traders can use wider SL(Stop Loss) and aim for larger profit gains. In most cases, traders use 1% to 2% of their account capital for each trade. So, scalpers can enjoy comparatively higher risk-rewards than the swing traders.

• Scalping Needs Higher Skill Set and Knowledge than Swing

Scalping needs a higher level of technical analysis and instant decision-making ability. Contrarily, in swing trading, a trader requires both technical and fundamental analysis along with a strategic mindset.

Try SureShotFx signals to get the surefire trading signals with 90% accuracy without requiring analysis. Providing strategic signals for 29 forex pairs, gold, and indices, SSF is making serious waves.

• Differences in Trading Costs

One of the biggest challenges in scalping is cost management. Due to faster trade execution, the spreads and fees impact the overall net profit gain. Whereas, in swing trading, traders can make a small profit gain through fewer trades in the long run.

• More Reactive Trading Behaviours for Scalpers

Scalping requires a very reactive trading style. For example, scalpers need to be glued to the screen, make instant decisions, and deal with high mental stress. On the other hand, swing traders can flexibly place a trade in an analytical approach.

• Both Win in Trade Quantity and Profits

Scalpers place trades aiming for smaller profit gains per trade. But multiple trades in a day with consistency can be profitable. Contrarily, swing traders can aim for higher returns by holding a position for days to weeks.

• Scalping Needs More Monitoring than Swing

In scalping, continuous monitoring of the charts is a rule of thumb. Besides, checking on the market moves and changes in trends is also a part. Contrarily, swing trading does not need constant monitoring. Swing traders can enjoy a more balanced trading than the scalpers.

And nowadays, thanks to SureShotFX Algo for such an amazing automated trading strategy. No need to be glued to the screen; just set the algo on the trading platform and relax!!

So, who earns more, scalper or swing trader? Both can earn more if the strategies are applied properly.

Risk Factors in Scalp Trading Vs Swing Trading

| Risk Factor | Scalping | Swing Trading |

|---|---|---|

| Execution Risk | Higher slippage, latency issues | Moderate – easier execution |

| Mental Stress | Very high – constant monitoring & fast decision | Moderate – comparatively balanced |

| Market Trend Risk | Lower – quick execution | Higher – mistakes in chart analysis can cause great loss |

| Overnight Risk | No chance | Moderate to higher – major events can hit stop-losses |

Scalping Vs Swing Trading Chart Difference

The main difference between scalping and swing trading charts is that the scalping charts are like a close-up picture of the market movements in seconds or minutes. It shows every tiny detail.

On the other side, a swing trading chart is a broader view of the overall market movements. This can be daily or weekly movements, so that the market trends and swings are visible.

Swing vs. Scalping Trading: Which is Best for Forex?

Due to high volatility, scalping is suitable for Forex trading. Forex scalpers can target 5–10 pips in liquid pairs like EUR/USD. But swing Forex traders hold trades for 100–300 pip moves, based on commission rates and geopolitics.

You can try the SureShotFX Algo, which comes with scalping strategies that are proven profitable and trusted by thousands of traders worldwide for profit in the highly volatile Forex market.

Scalping vs. Swing: Which Strategy is Suitable for Gold Trading?

Scalping gold is better for short-term price moves, while swing trading gold works for longer-term economic trends.

Gold market typically moves $20–40 per day; scalpers usually target $1–$5 per trade during high-volatility hours, like the London & New York overlap.

Swing Trading vs. Scalping: Which is Best for Indices Trading?

Among scalping and swing, swing is the best strategy for indices trading. Scalping indices needs quick reactions, which is risky in such a volatile market.

So, swing trading indices suits those following broader market cycles. And SureShotFX swing signals for indices trading are worth trying.

Besides, with a noticeable number of Trustpilot reviews and powerful community support, SureShotFx is creating new waves of trading for every type of trader.

Scalping Vs Swing Trading Winning Percentages

The success rate of scalping trading is higher compared to swing trading. And one of the key reasons behind this is high trade frequency within moments.

Based on various industry sources, TradingView claims that, within 5 minutes of scalping, the success rate is around 50-70% due to multiple trades with small price movements. Whereas, a swing trader’s success rate is around 30-50% because of lower trade frequency and larger price movements.

Swing trading often outpaces scalping in net returns due to larger moves and fewer costs with bid-ask spreads. If we compare different study reports on the success rate of swing and scalping strategies, we can see-

| Study Done By | Success Rate/Win Rate of Scalping | Success Rate/Win Rate of Swing Trading |

| TraderLion (April 2025) | 75%-84% | 35% and 50% |

| VectorVest (2024) | 55% and 80% | 35% – 50% |

| University of California (2019) | 6%-8% annual return | 12.6% of annual return |

| Journal of Trading (2018) | 41.4% | 55.6% |

Scalping Vs. Swing Trading- Which is More Profitable?

Though profitability depends on the trader’s strategy and expertise, scalping can be profitable due to high trade frequency and quick, small gains. But it needs significant capital, constant chart monitoring, and strict disciplined strategies.

However, if you are a complete beginner trader, day trading can be more profitable compared to swing trading. However, many often ask, Can I switch between scalping and swing trading? The answer is definitely yes. As a trader, you always have the option of which trading strategy you want to follow.

Recently, a discussion among Forex traders proved that scalping literally gives more stress and pressure, and so most traders don’t prefer it. Studies also show that 85% of scalping strategies fail within 6 months.

But here’s the catch! With SureShotFX Algo, you can change the game for retail scalpers. With the combination of the best MA indicators and other strategies, most of the trades by SSFAlgo are scalping, and people are getting profits after using it.

Best Signal Provider for Scalping and Swing Trading in 2026

SureShotFx provides the best signals optimized for both swing and scalping. So, you don’t have to take the headache of analyzing charts for hours.

Nowadays, our scalping signals have been proven to be one of the best Forex signals. Besides, we are one of the most accurate swing signal providers for profitable gold and forex trading.

The SureShotFx team uses strong market analysis to find the best entry and exit points. Whether you’re trading in the USA, UK, or worldwide, our signals help you catch short-term moves or hold trades for bigger profits.

SureShotFX Is Making Headlines!

Yes, the buzz is real! SureShotFX is turning heads across the trading world and grabbing major media attention. Recently, SureShotFx has been featured by Benzinga, TheStreet, StreetInsider, and more—and that’s for good reason, of course. Launching Free Live Signal Service for Forex, Gold, and Indices on its website, it is shaking up the trading world.

Not only this! Right now, you can unlock the VIP Channel Access with a 20% Discount when you register with Eightcap through SureShotFX.

That means full access to premium signals, SSF copier tools, and a smarter way to trade — all while saving money.

Final Wrap: Which Trading Style Suits You?

We have reached the end of our battle of scalping vs swing trading. Hopefully, now you can easily decide which type of trading is most profitable—scalping or swing trading.

Swing traders usually net more per trade, but scalpers rely on volume. For most retail traders, swing trading is more predictable and scalable.

So, if you are a seasoned, full-time trader with stable brokers and quick execution, scalping is for you, no doubt. However, choose swing trading if you want to trade alongside your 9–5 job, are patient with profits, and prefer combining technical and fundamental analysis.

However, whether you want to trade with a scalping or a swing strategy, contact us now to try our free signal strategies.

FAQs

Scalpers make $3-$5 per trade on average. While the amount might seem very small, scalpers execute dozens to hundreds of trades daily, adding up to $100 to $500 profit.

Yes, scalping is suitable for beginners with demo accounts only. Scalping requires precision with decision-making and instant trade execution, so for beginners learning trades, it will not be ideal to apply scalping with a live account.

No, scalping is not easier than swing trading. Instead, scalping needs higher trading skills and a strategic mindset. Besides, scalpers need a strong ability to control emotion, which makes scalping more difficult than swing trading.

Major currency pairs like EUR/USD, USD/JPY, and GBP/USD are best for scalping. Due to liquidity and low spreads, these pairs make scalping smoother only if you are skilled enough at the scalp trading strategy.

3, 5, 8, and 21 EMAs are mostly used as moving averages by skilled scalpers. Usually, to trade within the moderate-strength market trend, the 21 EMA is ideal. Gradually, with practice, you can use 3 or 5 EMAs on steep trends.

If we take a look at different studies, the success rate of scalping trading is 60–65% for each trade. However, the overall profit gain shows only 10-15% of total investment capital.

Yes, scalping can work in options trading. But to apply scalping in the options market, traders must manage execution costs and choose liquid contracts for tight spreads.

Of course. Both scalping and swing trading can be automated using Algo trading strategies. For scalping, speed and high-frequency triggers are a must. And for an automated swing strategy, technical rules and alerts are crucial.

2 Comments