Scalping Strategies in Forex Trading

Want to make quick trades without looking all day to the boring monitor? If yes, then keep reading on to know how you can use scalping strategies to make quick bucks!

Scalping is a trading strategy that involves making multiple small profits on minor price changes throughout the day. Traders’ open positions for very short timeframes trying to profit from buying and selling volatility. Intriguing, right? So, without any further ado let’s dive into the details.

What is Scalping in Forex?

In the forex market, scalping means traders open positions and close them within minutes or seconds. They target very small price movements to make profits before volatility dies down.

It’s a trading strategy where traders aim to make small profits from rapid price movements within very short timeframes. These timeframes can be as short as seconds or minutes. Scalpers make numerous trades throughout a single trading session, capitalizing on the tiniest price fluctuations. They may open and close multiple trades each day, making tiny profits on each small price swing.

Scalpers: Scalpers take day trading to the next level. They make lightning-fast trades, aiming to profit from minor price movements. It’s like catching quick glimpses of opportunities in a fast-paced market.

Indicators: Scalpers rely on fast-reacting technical indicators that identify short-term trend changes. These tools help scalpers act fast to capture small profits during temporary price fluctuations successfully.

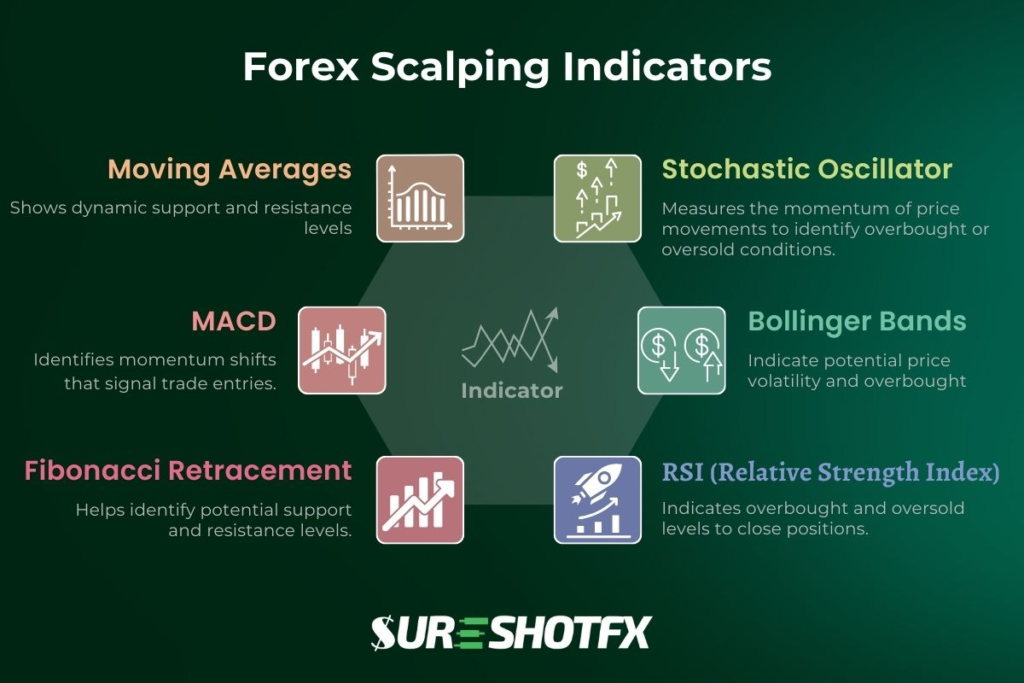

Some common forex scalping indicators include:

- Moving Averages: Shows dynamic support and resistance levels. These helps identify trends and potential entry and exit points.

- Stochastic Oscillator: Measures the momentum of price movements to identify overbought or oversold conditions.

- Fibonacci Retracement: Helps identify potential support and resistance levels.

- MACD: Identifies momentum shifts that signal trade entries.

- Bollinger Bands: Indicate potential price volatility and overbought or oversold conditions and displays periods of high and low volatility.

- RSI (Relative Strength Index): Indicates overbought and oversold levels to close positions. It also helps traders spot potential reversal points in the market.

Is Scalping for You?

Successful forex scalping strategies requires discipline, decisiveness, and composure. Scalpers must act quickly when their indicators signal an opportunity. However, they must also strictly follow their risk management rules when closing losing positions.

As one of your scalping strategies – you must aim to profit from small intraday price movements. Just know that scalping is the most active intraday trading style. You’ll need to sit glued to your screens for hours watching tick data.

It also requires decisiveness – any hesitation and your profit window may disappear. Not everyone is suited for scalping in forex. As not everyone can handle the pressure from this.

- It takes a resilient personality to repeatedly open and close trades in minutes all day long. Scalpers must accept frequent small losses as part of the strategy.

- Scalpers must adhere strictly to their trading plan and not be swayed by emotions.

- As mentioned before, rapid decision-making is crucial when price movements happen in seconds.

- Scalping can be intense, so being able to handle stress is essential.

- Successful scalping strategies needs analyzing charts and indicators effectively.

Scalping Strategies to Succeed in Forex

- Use a reliable forex broker with tight spreads and fast execution. This keeps transaction costs low. Also search for a broker that has minimal slippage.

- Trade only the most liquid currency pairs like EUR/USD and USD/JPY. They have stable volatility.

- The most liquidity and price movements occur during major trading sessions.

- Set stop-loss orders to limit potential losses.

- Follow short-term charts like the 1- or 5-minute timeframes. Identify setups early. Focus on a shorter time frame.

- Keep position sizes small – risk only 1-2% of your account per trade. Losses add up fast when scalping.

- Keep an eye on economic news and events that can impact currency movements.

- Set clear profit targets and stop losses. Close trades quickly once they are reached.

- Maintain discipline around your trading rules and risk management system.

Long Awaited Question: Is Scalping Worth the Shot?

Scalping can be profitable for experienced traders with the right personality and depends on your skills, strategy, and market conditions. They can generate income from small price swings that add up over time. But it requires great skills to cover the spread costs and consistently profit. It can be profitable for experienced scalpers who have honed their skills and developed effective strategies.

However, it’s not without risks, and beginners may experience losses as they learn the ropes. Beginners often lose money trying to scalp. It takes practice reading charts fast and maintaining composure during volatility. There’s a more better solution. You can join SureShotFX VIP Signals and just copy the expert trades without much work. What’s more interesting is- you can use our telegram to mt4 copier to automatically copy trades from our VIP Channels. Want to know more? Contact us!

Key Steps for Manually Scalping Forex:

1. Identify currency pairs with ideal volatility and liquidity using short-term charts. Focus on major currency pairs with high liquidity and low spreads.

2. Wait for your indicators, like the MACD or RSI, to signal a new trend emerging. Apply your chosen indicators to identify potential entry and exit points.

3. Enter a buy or sell trade quickly once you get a clear signal. Define your risk tolerance by setting a tight stop loss and profit target. Enter and exit trades quickly when your indicators align with your strategy.

4. Watch the trade closely and be ready to close it quickly once your targets are hit.

5. Look to repeat the process on whatever new trading opportunity arises next.

6. End each trading session by reviewing your trades and stats for improvement areas.

And For Automated Forex Scalping?

Gotcha! For automated scalping, trading bots enter and exit positions faster than humans can. Bots react instantaneously when price and indicators match their strategy coding.

Burning Question: When To Scalp?

- The best time to scalp forex depends on when your chosen currency pairs are most active. Generally the London session between 3am to noon EST offers optimal volatility and liquidity. Scalping during major trading sessions can provide more liquidity and price movements.

- Pay attention to economic releases and events that can cause sudden price movements.

- Look for currency pairs with increased volatility for better scalping opportunities.

- Avoid weekends and holidays when volume is lower. Scalping profits from active, liquid markets. Schedule your trading accordingly.

Conclusion

In summary, scalping forex aims to profit from minor intraday price fluctuations. It requires speed, skill, discipline and resilience. Follow prudent practices and indicators to boost your chances of success. While it can be profitable for experienced traders, beginners should approach it with caution and practice on demo accounts.

Start manually then consider automating once consistent. Remember that like any trading strategy, scalping carries risks, so always trade responsibly and within your means. Happy scalping!

4 Comments